STATE BANK OF INDIA Home Loan Transfer

Table of Content

Usually people go for home loan transfer if they come across a bank offering a lower rate of interest and attractive top up offers. To go for a home loan one needs to calculate savings on the Home loan balance transfer and fill an online application form for the same. A number of home loan balance transfer offers are available so that the customer has a variety of options to compare them and choose the best offer according to his/her own convenience. These documents are required to prove your employment. SBI Agricultural Gold Loan to enable farmers to meet their short-term needs for agricultural loans.

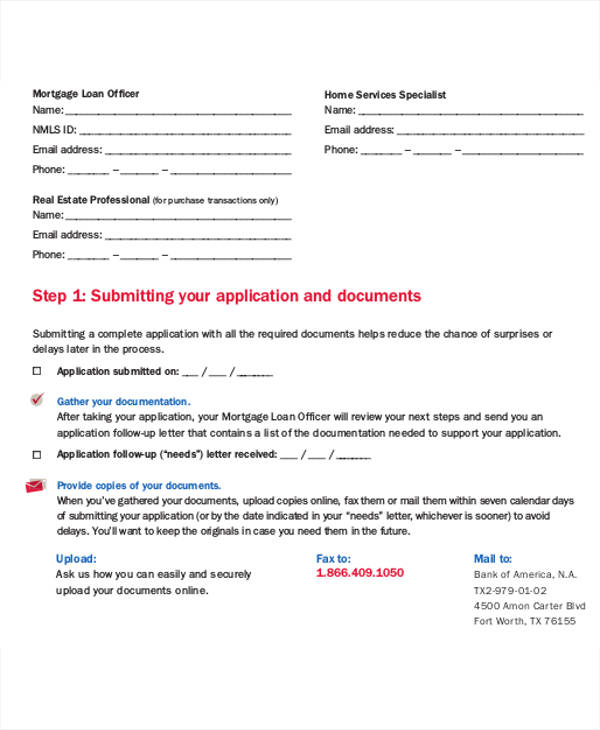

In this stage both the banks involved require a set of specific documents to complete the switching process. The previous bank will only release the documents if they receive a check of the balance amount and the new bank will issue the cheque only if the document. This NOC should be submitted to SBI and a request should be made to the bank by the applicant to pay off its balance amount to Bank 1 by debiting the loan account of the applicant.

Features & Benefits of SBI Balance Transfer

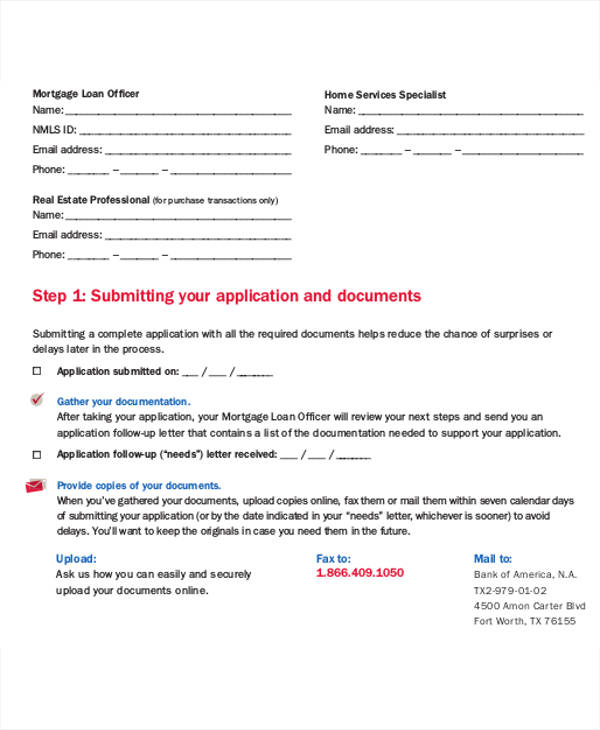

Address a letter to your bank and request them to transfer the title deeds and mandatory documents to SBI upon receipt of the loan amount. One set is specifically meant for home loan transfer and the other is a general set of documents which are required by mostly all the banks to fulfil the basic criteria of the loan. Once the offer is accepted, the applicant must submit the application form with the necessary documents. Once you accept the home loan, you have to complete the application for the SBI home loan and submit it along with the documents required.

Its some painfully slow process and documentation required are quite large, but if you check other points, this ensure you have all required documentation. Salaried as well as self employed individuals can apply for a home loan transfer. A good credit score is necessary to avail the facility of home loan transfer. Profit and loss statement that is accredited by a chartered accountant. Submit a form with all the necessary eligibility details.

SBI lowers Home Loan Rates for New Individual Loans Above Rs 75 Lacs

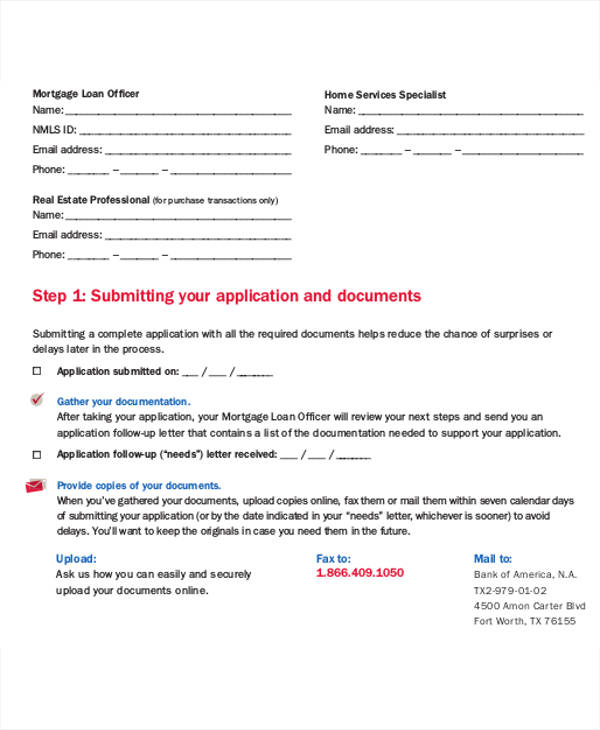

SBI home loan transfer charges are pocket friendly so that the applicants do not feel burdened with the payments. As SBI bank provides numerous services to its customers home loan transfer is also one of the many services it provides. Home loan balance transfer is nothing but transferring your running loan from current bank to another bank or NBFC to make your loan journey more smooth. People mostly opt for home loan transfer because other banks offer them much more benefits in terms of lower interest rates and pocket friendly EMI. Fulfill the SBI home loan document required to get a quick home loan approval. The list of SBI home loan documents varies for existing and new customers.

SBI offers a broad portfolio of retail loans and SBI home loan is one of the most preferred option by home buyers. Read on for more information on documentation and guarantor requirements to avail a home loan from SBI. We have a network that is unmatched in terms of reach.

SBI Home Loan Balance Transfer

All the financial requirements and services provided by Iserve financial are available free of cost for the customers and one can avail them without any hesitation. There are about 1000 products that we offer along with the right mix of finance. State Bank of India allows customers to transfer the balance from existing home loans with other banks or financial entities to SBI in order to enjoy the features and benefits of the SBI Home loans. SBI does charge on processing fees, but it is 1% of the outstanding loan money.

You can easily apply for SBI home loan but you require certain documents ready, if you want your application to be approved faster and easily. By clicking "Proceed" button, you will be redirected from SBI website to the resources located on servers maintained and operated by third parties. SBI doesn't take any responsibility for the images, pictures, plan, layout, size, cost, materials or any other contents in the said site. By clicking the "Proceed" button, you will be agreeing to the above. Max Gain OD account is actually a home loan account with feature of overdraft.

The most important part is that as a borrower, you should have all the valid documents evidencing your ongoing loan and the property details with evidence/proofs. How do I know if I will benefit from a home loan transfer? It would be wise to do a cost analysis and see if switching over would save money.

Copy of Form 16 for last 2 years or copy of IT Returns for last 2 financial years, acknowledged by IT Department. You can visit the nearest SBI branch and apply for the loan physically. You can apply for an SBI home loan in three different ways. Address record of your blood relatives you are staying with overseas.

The reasons why one might choose to transfer the home loan balance are as follows 1. How do I apply for the transfer of the State Bank of India home loan? In addition, the borrower must have valid documents proving the title of the house/apartment. This is where the transfer of the mortgage balance comes into question. You can check the transfer of the home loan balance online by providing the application number or by contacting the State Bank of India customer support number.

Can I avail of a higher loan amount from SBI when I transfer my loan? Yes, SBI sanctions loans higher than the amount taken over for the purpose of renovation, extension, or furnishings. This is subject to the merits of the case and requirements and eligibility of the borrower. Valuer's fee for valuation report.Post-sanction Stamp duty applicable on loan agreement and mortgage. Your background should be clear and the photos must have clarity.

Comments

Post a Comment